32+ payroll tax calculator oklahoma

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Web Oklahoma Paycheck Calculator.

Free Oklahoma Payroll Calculator 2023 Ok Tax Rates Onpay

Add W-2 employees at any time.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. Gross income Retirement contributions Adjusted gross. Web Oklahoma Income Tax Calculator 2022-2023.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Oklahoma. Single filers will pay. It will calculate net paycheck amount that an employee will receive.

Well do the math for youall you need to. Payroll check calculator is updated for payroll year 2023 and new W4. Web 2023 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

Calculate net payroll amount after payroll taxes federal withholding including Social Security. Web Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. 905 Asp Avenue Room 244 Hours of Operation Lobby Hours.

Just enter the wages tax withholdings and other. Monday - Friday in accordance. Your average tax rate is 1167 and your marginal.

Web For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount. Add W-2 employees at any time. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

Determine your filing status. Calculating your Oklahoma state income tax is similar to the steps we listed on our Federal. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Web Oklahoma Hourly Paycheck Calculator. Web Calculate your Oklahoma state income tax with the following six steps. Ad Compare This Years Top 5 Free Payroll Software.

Over 700000 Businesses Utilize Our Fast Easy Payroll. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Free Unbiased Reviews Top Picks.

If you make 70000 a year living in Oklahoma you will be taxed 10955. Web The Oklahoma Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. From 9800 to 12200.

Sign Up Today And Join The Team. Web With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. Learn About Payroll Tax Systems.

Hourly employees who work overtime. Tax rates range from 025 to 475. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Sign Up Today And Join The Team. If this employees pay frequency is weekly the calculation is. Learn About Payroll Tax Systems.

Web Oklahoma Paycheck Calculator. Enter your info to see your take home pay. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. All Services Backed by Tax Guarantee. Web The minimum wage in Oklahoma is whatever the minimum wage is at the federal level which is currently 725 per hour.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web Packet OW-2 Revised 11-2021 2022 Oklahoma Income Tax Withholding Tables Effective Date.

Web So the tax year 2022 will start from July 01 2021 to June 30 2022. Supports hourly salary income and. Ad Well file your 1099s new hire reports.

Ad Well file your 1099s new hire reports. Web From 7500 to 9800. Both a state standard deduction and a personal exemption exist for those eligible for the.

Over 700000 Businesses Utilize Our Fast Easy Payroll. This free easy to use payroll calculator will calculate your take home pay. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Jlab Go Air Pop True Wireless In Ear Headphones Bluetooth Headphones In Ear Buds Earphones And Usb Charging Box With Dual Connect Earbuds With Eq3 Sound And Microphone Black Amazon De Electronics Photo

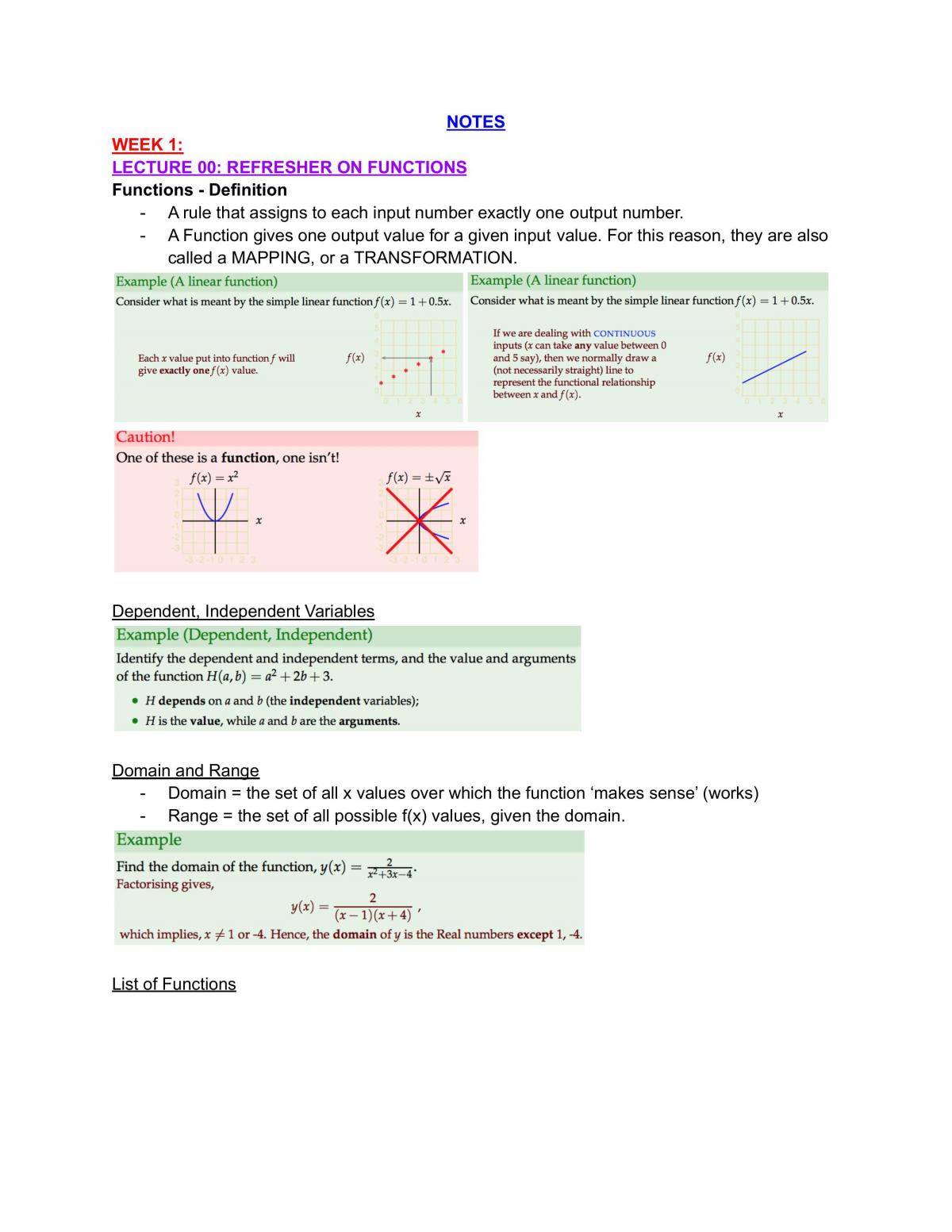

Mathematics For Business Science And Technology

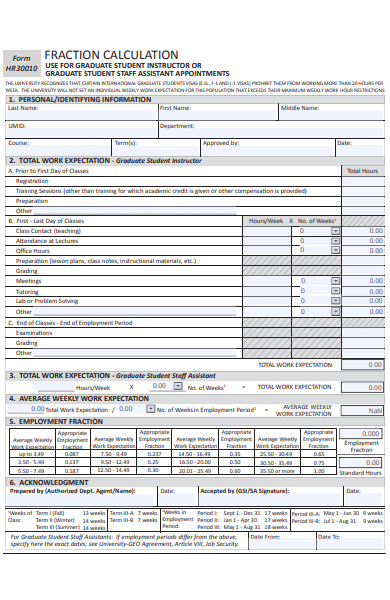

44 Payroll Templates Pdf Word Excel

Oklahoma Paycheck Calculator Smartasset

Econ1202 Notes Econ1202 Quantitative Methods A Unsw Thinkswap

Economist S View Carbon Taxes Vs Cap And Trade

Paycheck Calculator Take Home Pay Calculator

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Oklahoma Income Tax Calculator Smartasset

Free Income Tax Filing Portal In India Eztax

Payroll Tax Wikipedia

Featured

Pdf Policy Brief The Case For Electric Building Scale And Speed For Zero Emissions Mobility

Free 31 Calculation Forms In Pdf Ms Word

Oklahoma Income Tax Calculator Smartasset

How To Calculate Payroll Taxes Wrapbook

How To Calculate Payroll Taxes Wrapbook